| This article is aimed at readers in the United Kingdom 🇬🇧 For articles aimed at readers in other countries please go here and choose your country. |

One of the biggest concerns for many families is how to pay for care in the UK. The advice in this article can be used to help:

- Pay for a professional carer

- Financially support a non-professional carer (i.e family member) while they are caring

- Pay for normal day-to-day expenses that both your loved one and anyone caring for them will need to cover

My own experience of caring for and managing finances for both my dad and my mum left me wishing I knew the below steps ahead of time, I spent a lot of time researching and exploring options, and here is everything I learned.

How and when you move forward is going to depend on how independent your loved one is (at this time), their attitude to being helped, and how the rest of the family feels about the matter. If your loved one is still very independent then maybe it is just a matter of providing advice. However, if they are starting to struggle to manage and act on financial matters then you may need to be more practically involved. With almost everything in this article, the sooner you do it (or at least familiarise yourself with it) the better.

Almost everything up to stage 7 will apply in almost all cases and I highly recommend you do all of them. Stages 8 and 9 list all of the funding sources that may be available to you. Finally, stage 10 is how you bring these all together.

Step 1: Directly address any tensions or reservations

When it comes to caring for someone, the topic of finances can be sensitive. There may be some trust issues involved, either from the person being cared for and/or from other family members, also managing our own money is a big part of being independent, so losing that ability can be very difficult for your loved one. Now and going forward you should make sure to:

- Understand existing plans and expectations. Before you get started, find out if your loved one and/or other family members already have a plan. If so, make sure everyone understands it so you can help deliver and (if need be) improve it.

- Explain the need for a plan and your involvement. If no sufficient plan exists, make sure everyone understands the benefits of the plan and the implications if things are not managed well.

- Be transparent, keep a record, and keep everyone up to date on important decisions. Make sure that your loved one and your family can view all transactions and maintain transparency at all times.

Step 2: Make sure you have an overview of available income, savings, and expenditures

Talk with your loved one and try to get a full picture of their financial circumstances. Ask if it is okay to look at bank statements and any recent correspondence that will help you to get a detailed picture. You should try to find out the following:

- What debts are there?

- Credit card

- Mortgage

- Loans

- Finance agreements

- Overdrafts

- What bank accounts are there?

- Debit

- Credit

- Savings

- What income is there? For example royalties or tenants

- What pensions, shares, bonds, or other financial initiatives is money tied up in?

- What property and assets are there? How much are they worth? (it may be worth getting a free up to date valuation of any properties at an early stage)

- What are the regular monthly costs?

- Car and travel costs

- Council tax

- Water

- Internet

- Electricity

- Subscriptions

- Food

- Insurances (Car, Home, Personal)

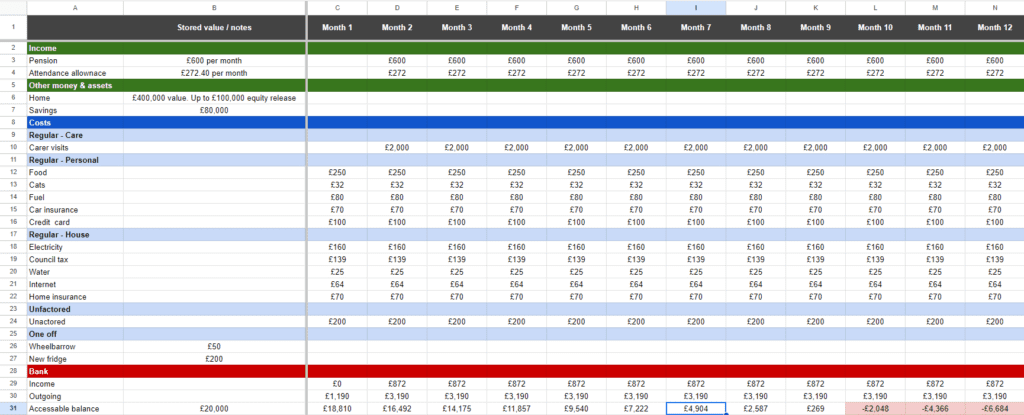

To record all of your findings, check out the ‘Tools’ section at the bottom of this article to download our template spreadsheet. This will help you to calculate monthly and future costs.

Step 3: Apply for Power of Attorney

This gives you the ability to act on behalf of your loved one when making certain financial decisions. This becomes especially important if your loved one loses the ability to articulate themselves and/or travel entirely.

You should do this straight away as it can take a few months to come through and if your loved one’s health deteriorates very quickly you will have a really hard time if this is not in place.

The relevant one here is called ‘Property and financial affairs’ but you should also do the ‘Health and welfare’ at the same time (This one applies to decisions regarding ongoing medical treatment).

Step 4: Make sure a will is in place

This may sound abrupt but it is also relevant to decisions made before someone has passed away. Depending on how care is funded the estate may have debts (such as equity release) where being able to access assets relatively easily after someone has passed away is going to be important. This process and everything else will be massively complicated if an up-to-date will is not in place. It will also make life much harder for your family at an already difficult time. The article below offers many options for will writing from DIY to affordable solicitor services.

Explore will writing services

Step 5: When the time comes, make sure you have access to the relevant accounts

This is a delicate point and one that you may need to come back to at a later point, depending on how independent the person you are supporting is at this time. You should only use or access someone’s bank cards and accounts with explicit permission from the owner and full transparency about what you are doing with them.

That said, if you have not already, you will likely reach a point where you will need to perform day-to-day purchases and financial tasks on behalf of your loved one. So talk to your loved one and make sure this is possible ahead of time.

You may also have to support your loved one with releasing funds from other sources. This is where the Lasting Power of atourney is vital but, in the meantime, you may be able to do this with your loved one providing spoken permission where needed.

Step 6: Cut unnecessary costs

With an elderly relative, there may be many costs that are no longer needed, forgotten about, or maybe coming from a provider that is not giving them the best deal. These can include an extra car, inefficient and/or under-utilised household appliances, forgotten subscriptions, credit card interest or simply buying too much food then throwing it away. Try to identify these costs and either get rid of them or find a better deal. The best way to identify these costs is to look at a list of bank transactions.

Step 7: Get an assessment from your loved one’s local authority

This is important for many reasons both financial and practical. Local authorities will provide an assessment that looks at your loved one’s health and financial situation. It will make you aware of any specialist equipment or home adaptations you can receive which will help with mobility and other needs. They will also identify if your loved one meets certain financial criteria, in which case will be eligible for state-subsidised care visits (more on this in the next section).

Learn more and apply for an assessment here

Learn more about the criteria for funded care

Step 8: Explore all national and local authority funding

Make sure you and your loved one are receiving all national and local financial support you are entitled to. Here are the national and standardised local initiatives in place to support carers and those they care for.

Carers allowance (Non-professional carers only)

A carer’s allowance is money given to anyone caring for someone for no less than 35 hours a week and earns less than a certain amount each week, so this is only relevant if you (or another family member) is the carer. If you fall within this bracket, it is recommended that you claim your carer’s allowance.

Read more and apply on the .gov website

Attendance allowance or PIP

This is for the person being cared for and will help with their living costs. If someone has a carer they will very likely be eligible for one or the nother

Read more about Attendance allowance on .gov

Read more bout Personal independence payments on .gov

Universal Credit (Non-professional carers only)

Universal credit provides financial support for those between work or unable to work. As a non-professional carer, your ability to work can be massively reduced so this is definitely a funding source to explore.

Read more and apply on the .gov website

Local authority subsidised care

This is available to anyone with savings below a certain threshold. Rather than providing finance, your local authority may be able to subsidise the cost of having professional carers come in at regular intervals. Be aware, depending on where you live, that this initiative may have a lot of demand and (at the time of writing) we are facing a long-lasting carer crisis (especially in the public sector) so this can affect how long you wait, how much care time you are allocated and the quality of available visits. That said, we recommend you fully explore this option (if eligible) and make an educated decision.

The application process varies for each UK county so you will need to look up your local adult social services website and contact them to arrange this.

Council tax reduction

If the carer lives with the person they are caring for, they may be entitled to a council tax reduction. Check with your local council for more details on this.

VAT reduction for those with disabilities or long-term conditions

Those with disabilities or a long-term illness are eligible for VAT relief (20% off) services or products that help them manage their condition at home. Disability specialists providing specialized equipment will probably already know about and apply this but other companies may not. If you are purchasing something that helps your loved one manage a disability or long term illness make sure to ask about this.

More information on the .gov website here

Carers credit (Non-professional carers only)

This will help with gaps in your National insurance payments while you are caring. Once again, this is only relevant if you (or another family member) is the carer.

Pension credit (Non-professional carers only)

Pension Credit will help you if you are over State Pension age and dont have much income. It can also help with ground rent or service charges.

Step 9: Understand self-funding options

It is important to mention at this point I am not a qualified financial advisor so this section is designed simply to list the options we know of and spark further investigation into the ones your loved one may be able to access. Each source will have its benefits and limitations so you should consider the following and include it in your plans:

- How much is needed?

- Is the source making money, losing money, or standing still? For example, if share values are increasing it may be better to leave those as a last resort. Equally, equity release can be a great option but you will be charged interest.

- Has tax already been paid on it? does tax need to be paid?

- How quickly can it be accessed? How far ahead will I have to put things in motion?

Self-funding sources include:

- Income & pensions:

- Tenants

- Royalties

- Dividends

- Savings and investments

- ISAs

- Bonds

- Stocks and shares

- Assets

- Selling things – Extra cars, unwanted valuables

- Equity release – This is where part of the value of a house is paid out as a loan, this loan is repaid when the home is sold (usually after the last owner has passed away)

- Downsizing – Moving into a smaller home

10: Plan ahead

Once you have a good understanding of the financial situation and have done everything possible at this time. Plan ahead.

Use information from step 1 to work out how much care and day-to-day life is going to cost month by month and how long this arrangement will last before a new approach is needed.

For example, we managed to support my mum and dad for a while with savings and public funding, but eventually, we had to do equity release on their property. We knew when we had to start this process because we had a plan.

Planning tools

As someone with a business background, I do find a spreadsheet very helpful here as it means you can see everything in one place and very quickly make changes and test ideas.

Additional help

Depending on the complexity of the financial situation, it may be good to seek personalized advice, this may be especially important if

- Your loved one has no income, savings or assets

- Your loved one has a large and/or complex estate

- Your loved one does not have UK Citizenship

- Your loved one has problems with gambling or is very bad with money